Cronite Group: CFC/Alloy Hybrid – The Next Generation Solution

With 100 years of experience in the design and manufacture of refractory alloy castings to the heat treatment market, the Cronite Group added machining and assembly of graphite and CFC (C-C) fixtures to the product offerings in 1995. The Carbon factory in Arnage, France produces a full range of products from graphite furnace parts to complex 3D CFC (C-C) fixtures.

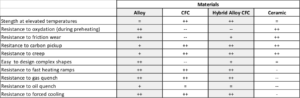

Latest fixture development is new generation of refractory alloys and carbon materials to achieve the perfect balance of cost, strength, weight, and temperature/process resistance. This technology could be applied in vacuum heat treatment, atmosphere carburizing/hardening and low pressure carburizing with gas or oil quenching. Combine the benefits of each material to maximize load size, life cycle and process results all while minimizing cost. There are many aspects to be considered when designing the optimal hybrid CFC/Alloy fixture and the Cronite Groups expertise in design, alloy development, casting, machining and your heat treatment process allows to develop and deliver the optimal solution. Distortion reduction, wear and abrasion resistance during loading/unloading, elimination of eutectic points are just a few of the additional considerations taken when developing the most cost effective solution.

The following ring gear fixture example for the LPC illustrates the concept. The base tray and the vertical grid are supplied as castings in Mancellium (new proprietary carburization resistant CR alloys). An alloy base tray is better suited for the interface with the furnace internal material handling. The vertical support grid is also ideally suited for supply as a casting in one of the carburization resistant alloys (low dimensional change) due to the lower cost and direct load transfer to the base tray. The CFC arms provide greater strength elimination of creep deformation to support the overhung load of gears. This elimination of creep deformation is ideally suited for automated loading/unloading.

Image 1: Mancellium CFC arms in Mancellium fixture

Image 2: Mancellium lost wax adapter on 3D CFC arm

Part adapters are produced using lost wax due to the size and for the precision interface with the CFC arms without additional machining. Using alloy for the ring gear contact points eliminated abrasion wear on the CFC during loading/unloading.

The Cronite design team utilizes Finite Element Analysis and Simulation-Driven Design software to ensure the solutions are perfectly suited for their application. Fixtures are optimized to maintain a high safety margin while reducing the use of expensive carbon composite elements. Use of these FEA and Simulation software tools for strength, creep, and deflection calculation allows design team to rapidly develop fixture solutions with longer service life and reduction of customer part distortion during the heat treatment process.

Image 3: ¼ of CFC tray under load. Deformation scaled up.

The Cronite Groups extensive R&D laboratory performs extensive destructive, fatigue, cycle, and environmental testing to confirm real world results match FEA methods results for alloys and relevant fiber orientation CFCs.

Image 4: CFC sample test probes.

This independent analysis and testing of CFC materials has provided an extensive and reliable material performance database for use in computer modeling software and selection of the highest quality CFC manufacturers.

Image 5: Stress-strain curves of a small CFC sample set.

As shown on the stress-strain image above, CFC materials exhibit exceptional strength and predictable deflection at elevated temperature.

The material alone is not sufficient to guarantee satisfactory results. Parts must be properly supported and guided to minimize distortion, which can be difficult or cost prohibitive with a CFC only solution. This hybrid combination of CFC with cast alloy part supports solves this problem.

Image 6: Cast adapter on CFC grid.

Image 7: Lost wax Mancellium adapter.

The use of cast carburization resistant and non-stick materials like Mancellium and CR Alloys for the part contacting elements eliminates the potential of carbon transfer from the CFC to the customer part, eutectic points, and wear or fracture of the CFC surfaces during manual or automated loading/unloading. Cast alloy contact elements are also superior to ceramics as they are more resistant to the fast heating and cooling rates of the heat treatment process. Cast alloys also exhibit similar thermal growth as the fixtured parts, preventing another potential source of heat treatment distortion.

Cronite employs multiple rapid prototype techniques and processes in production facilities and can deliver fixtures for benchmark and development testing quickly and cost efficiently.

Image 8: Plastic print on customer part.

Image 9: Printed cast supports.

3D printing of full-scale plastic prototypes provides all customers with visual and hands-on tools for confirming functionality, automation compatibility and ergonomic use in the working environment prior to machining of the production pattern. 3D printing technology was adapted for use with lost wax compatible materials for rapid production of alloy fixtures for PPAP and heat treatment development projects.

On the 18th October 2018, the Safe Cronite business unit of the Safe Group has been purchased by its CEO Pierre Wittmann and a group of managers in partnership with investment funds driven by CICLAD. Cronite is a world leader in the design and production of fixtures and parts in refractory alloys for heat treatment, steel, incineration, power generation, automotive, and aerospace industries. Cronite employs around 800 people. It operates 7 plants in France, England, Germany, China, India, Mexico, and has a R & D and Design Center in the Czech Republic. Its sales offices in the United States, Japan, South Korea and Sweden propel a global coverage of 2,000 customers. Cronite is known world-wide under the names Cronite, Klefisch, Mancelle, North American Cronite, and Cronite CZ. Cronite is equipped with numerous production techniques: green sand for mass production, chemical sand for items over 2 Tons, lost wax for very accurate parts, carbon fiber composites, machining, welding and fabrication.

EMO VAIOCS cleaning machine – a must have for all professional heat treaters

After most of European commercial and captive heat treatment shops are having at least one, the aerospace industry is currently following

High-tech cleaning machine of engine components for the aerospace industry:

A leading manufacturer of aircraft and rocket engines was looking for the best process for cleaning engine components to be used in commercial aircrafts of Boeing and Airbus. With a hybrid process, combining aqueous and solvent-based cleaning in a single chamber, the high demands of the aerospace industry were finally achieved.

The hybrid cleaning machine with automatic loading and rotating cleaning chamber

High costs of rework saved

The components of aircraft engines are contaminated with organic and inorganic residues. This occurs during and after the manufacturing process. If the parts cleaning process does not allow to remove of all those residues, the following crack detection operation leads to incorrect results with unnecessary high rework costs. In fact there is mostly no quality defects but only residual contamination as a consequence of inadequate parts cleaning.

Hybrid cleaning process makes the break-through

In the search for a perfect cleaning process for this complicated task, the engine manufacturer came across the VAIOCS (Vacuum Assisted Inorganic Organic Cleaning System) Hybrid combined machine technology from EMO. All cleaning tests were performed at EMO’s Technical Centre of Cleaning Excellence. Also all residues were chemically analysed there. It became very clear that the aerospace requirements could be only met by Hybrid system.

Combination of aqueous and solvent-based cleaning steps

The newest generation of these machines combines aqueous and solvent-based cleaning steps, not just in one machine, but in a single treatment chamber. The cleaning process follows an ingenious six-step process scheme beginning with solvent cleaning. Next comes vapour degreasing before cleaning with an aqueous medium and rinsing with fully deionised water. Cleaning steps five and six consist of aqueous vapour rinsing and subsequent vacuum drying. The crucial point is: all cleaning steps run one after the other in the treatment chamber under vacuum at high temperatures. This not only ensures the best cleaning results, but also fast drying without residues.The reason why this process combination inherently leads to outstanding results is explained by Peter Hösel, Technical Director at EMO: „The contamination of the engine components consist of both organic substances such as oils and grease and inorganic residues such as emulsion residue, salts, shavings, debris and similar. Based on the fundamental law of chemistry that „like dissolves like”, organic contamination can be removed best with an organic, solvent-based cleaning medium, while inorganic residues are removed with an inorganic, water-based cleaner.

Only to remind our readers: EMO is the inventor and patent owner of the vacuum cleaning and drying technology, a tremendous technological jump of the last century. Their newest patented achievements are processes like CNp – Cyclic Nucleation Process, with results overtaking ultrasonic cleaning and process called Beyond, which is the next break-through of hybrid cleaning system, a new industrial parts cleaning method using a regenerative solvent-water mixture removing in one step and in one chamber organic and inorganic contamination.

Ralf Högel & Karol A. Forycki (GHTN)

August 18th, 2017

During this year edition of the CE European Heat Treatment Forum & Expo the Award “Member of the Heat Treatment Forum Hall of Excellence” was presented, after Michel J. Korwin and Janusz Kowalewski “The Godfather of Globalization” became members in the previous years, to Hans Veltrop. We congratulate!

This could be the most important acquisition in our branch these years!

Today (November 13th, 2015) the Japanese IHI Corporation was announcing that it has entered into an agreement to acquire 100% of the shares in one of the leading German provider of advanced heat treatment services VTN, with five plants in Germany including one in Wilthen (Eastern Germany) perfectly covering Eastern Europe.

VTN, headquartered in Witten, is mainly working for the automotive, aviation, construction and agricultural industry, with a net sales last year of approx. € 30 million. Strong in vacuum, atmosphere and induction technology as well.

IHI’s 100% subsidiary IHI Machinery and furnace Co., Ltd, biggest Japanese vacuum furnace manufacturer with more than 2200 installations worldwide is a leading company for vacuum carburizers using acetylene as carburizing gas, technology invented in 1996. IHI produces also multi cell vacuum carburizers and small batch vacuum furnaces, vacuum degreasers, diffusion bonding hot presses, high pressure sintering furnaces and calanders for tire industry.

We recall that IHI was acquiring in the past already Japan Hayes, Hauzer Techno Coating and Ionbond (previously within Bodycote organization).

This huge Japanese industrial conglomerate, established 1853, with a sales level of € 10,8 billion last year operates in mostly all industries incl. automotive, aviation, space, nuclear, energy and defense.

The acquisition of VTN in Germany will be the milestone for further expansion of IHI vacuum heat treatment technology on the European market. IHI with VTN and its other subsidiaries for surface treatment IHI Ionbond AG & IHI Hauzer Techno Coating B.V. will provide a full range of services in metal and non-metal applications, furthering IHI’s ambition of becoming a global leader in heat treatment and surface treatment technology, markets which are expected to show significant future growth.

IHI booth during last HeatTreatmentCongress in Cologne / Germany.

Gord Montgomery (The Monty), Paola Canal (Italy), Karol A. Forycki (GHTN), Shinji Okada (IHI Europe)

Karl-Wilhelm Burgdorf Prize 2015 goes to Hans Veltrop

October 30th, 2015

During yesterday’s Evening Gala Event at the biggest and most important European Heat Treatment Congress & Expo in Cologne (Germany), organized by the German Heat Treatment and Material Engineering Association AWT and this year again co-sponsored by the Global Heat Treatment Network, Mr. Hans Veltrop has been awarded with the famous and precious Karl-Wilhelm-Burgdorf prize. This annual prize was founded several years ago by the German premium hardening oil developer & supplier Burgdorf for the memory of Karl-Wilhelm Burgdorf who established the company 1949 and is awarded by the Board of the AWT.

Hans Veltrop, according to AWT, is transferring in his whole professional life in an extraordinary manner his scientific knowledge into daily heat treater’s business. He was starting his long successful career at Hauzer Techno Coating, later leading for a long time period Bodycote’s Central and Eastern European Group activities, being co-responsible for the fast expansion of that #1 commercial heat treater worldwide and now as important member of the Global Heat Treatment Network he is supporting several well-known market players and international corporations in the fields of equipment design and technology application.

He is engaged in heat treatment and coating business his whole life long, creating cutting edge developments already in the ’70, later inner companies he was working for, but also at equipment suppliers and customers as well (from automotive to aerospace). A countless number of customers worldwide are still taking advantage of his wide spread experience and several patents. Hans Veltrop as the pulse of our industry is also organizing heat treatment conferences, as an international acknowledged specialist giving presentations, or practical lessons to the equipment manufacturers and is well known (and feared for) as a critical questioner too, he is also taking care of knowledge transfer as well and encouraging science on new development directions. Congratulations!

2nd Central Eastern European Heat Treatment Forum & Expo

The Monty, May 5th, 2015

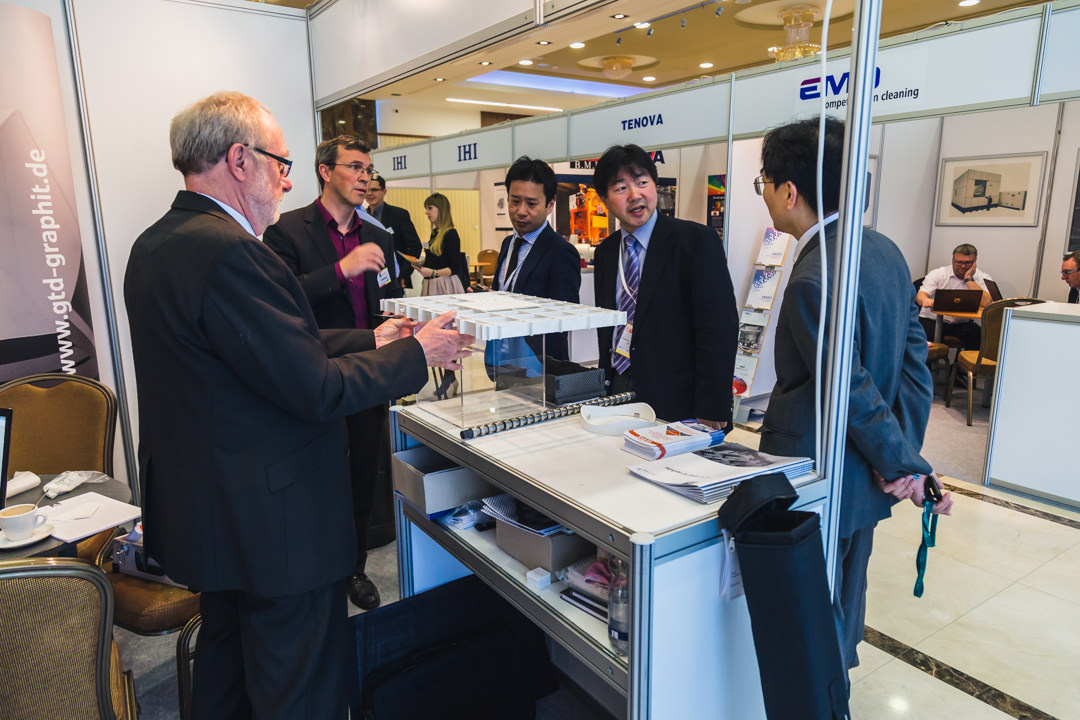

April saw the 2nd Central Eastern European Heat Treatment Forum Conference which was held in Wroclaw, Poland in conjunction with the 1st European Vacuum Carburizing Summit Conference both of which were organized by the Global Heat Treatment Network. This forum was first held in 2014 and it would appear that this is quickly becoming the premium heat treating forum in Poland and quite possibly Central Europe. Incidentally the leading European member of the GHTN network is Mr. Karol Forycki of Foka Engineering who was largely responsible for organizing this well planned event which had over 30 technical presentations and more than 40 exhibitors. The European Vacuum Carburizing Summit will be a regular meeting on developments and trends in that technology and will take place every two years at various locations in Europe, Asia and down the road North America (similar to the 2014 European Nitriding Summit).

During the gala dinner Mr. Janusz Kowalewski, Managing Director of ALD Dynatech was inducted into the Heat Treatment Forum Hall of Excellence as its newest member-if you recall Michel Korwin (Nitrex and UPC) is the first member of that Hall of Excellence. During the event we had the chance to talk to a lot of old and new friends including representatives from IHI Group of Japan, one of the largest Japanese industrial conglomerates with a number of interests in the heat treating industry including furnace manufacturing and heat treating. For instance in 2002 Japan Hayes, inventor of vacuum carburizing under acetylene (patented technology for pressures < 3mbar) was integrated into the group. This has lead to IHI having produced over 2100 vacuum furnaces and vacuum degreasers worldwide with 200 vacuum caburizing units also in the mix. Currently IHI is entering the European market with its new strategy including it’s own European R&D center and manufacturing site as well.

Gord Montgomery (The Monty), Karol A. Forycki (Global Heat Treatment Network), Michel J. Korwin (President & CEO of Nitrex & United Process Controls and 1st Member of the Heat Treatment Forum Hall of Excellence ), Janusz Kowalewski (CEO of Ald Dynatech and 2nd Member of the Heat Treatment Forum Hall of Excellence), Hans Veltrop, Gerry van der Kolk (CTO Ionbond/IHI Group), Shinji Okada dono (IHI Group Europe)

Janusz Kowalewski, Dale Montgomery, Gord Montgomery, Roman Pietrzyk (Industrial Forum)

Shinji Okada (IHI Group Europe) and Ichiro Nakamoto (IHI Group Japan)

Martin Bartelmie (GTD), Dr. Mathias Kunz (WPX), Shinji Okada, Kazuhiko Katsumata and Ichiro Nakamoto (IHI Group)

Hans Veltrop (HV Consultancy) and Harald Berger (Aichelin Group)

Karol A. Forycki (Leading Member of Global Heat Treatment Network)

Overview of the Global Heat Treatment Industry

December, 2014

Heat treatment is a combination of operations involving the heating, holding and cooling of metal in a solid state for the purpose of obtaining certain desirable metallurgical properties or surface modification. Heat treatment consumes 17% of US Industrial Energy usage and consists of 2 to 15% of the total production cost. (Source: IHEA)

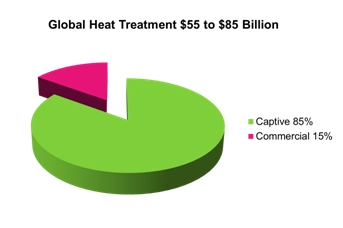

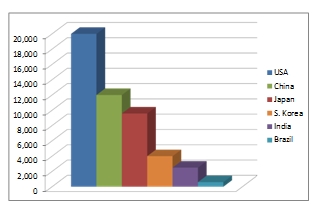

The global heat treatment volume is in the range of $65 to $85 billion. This volume range doesn’t included induction and primary iron and steel heat treatment, and is a relatively small industry compared to other global industries. The global heat treatment volume estimate is gathered from local heat treatment association’s statistics and correlated with countries’ car production and GDP. The common belief is that North America is a $20 billion industry with 16 million vehicles manufactured in the US in 2013 and $15 trillion GDP. China manufactures 19.5 million vehicles, has more than half of US GDP ($8.3 trillion), and 30% GDP is generated by manufacturing compared to a mere 12% in the US. The heat treatment should have half of the heat treatment market the US has, or even more. The European Union, with 14 million vehicles and the same combined GDP as the US – heat treatment volume, cannot be much lower compared to the US.

Source: Janusz Kowalewski (in Millions)

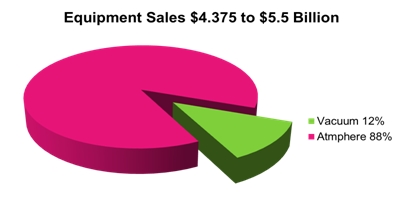

Many countries have considered heat treatment a strategic activity for the proper development of its economy and raising the standard of living. For example, South Korea, Poland and China have significant subsidies and grants provided to furnace manufacturers that develop advanced technologies. The estimated global heat treatment equipment sale is in the range of $4.375 and $5.5 billion.

The heat treatment equipment market is served by approx. 300 furnace manufacturers around the world. 300 companies is an arbitrary number and doesn’t match countries’ national data. For example, the China Heat Treatment Association claims that there are 750 companies related to heat treatment and India furnace manufacturers say 50, but not all the companies are heat treatment equipment manufacturers. Most likely, from the list of 300 furnace manufacturers, 10% of the companies should not be on the list because of their low technical capability and low production rates. The 300 companies on the list are located in 34 countries and on every continent. The majority of the furnace manufacturers are privately owned with several distinctive exceptions. Amongst the 10 biggest furnace companies in the world, only two are privately owned companies (Ebner and AFC-Holcroft). The other large companies are owned by investment groups (Ipsen,), industrial conglomerates (Tenova, Aichelin, ALD, Chugai Ro, DOWA) or are publicly traded companies (SECO/WARWICK, Fandong).

Globalization of the operation is very risky and requires huge financial and managerial resources. Most private companies do not have the sufficient financial resources, managerial resources and enough risk tolerance to support manufacturing globalization. Globalization is not related to international sales, since most companies from the list conduct international sales, but globalization means owning and operating international facilities around the world.

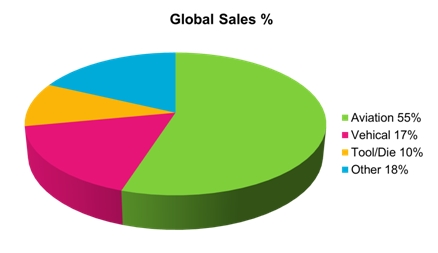

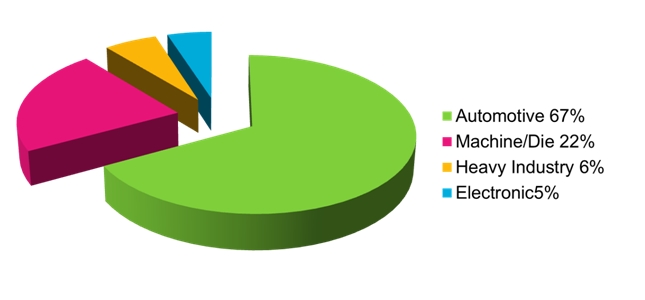

The global heat treatment drivers for heat treatment growth are the automobile, heavy construction, aviation, aerospace, metalworking, tool and die industries. Korean car company estimated that the production of 1 million-car production requires 100 average size sealed quench furnaces. In the average vehicle, 70% of weight is metal. This high percentage of metal in the vehicle has a profound influence over demand for heat treatment in this industry.

There are still very noticeable technical differences between heat treatment levels between countries and regions. The US, Japan and Europe still generate most of the new technologies in our business. At the same time, we can notice that the global heat treatment business is becoming more alike in application of American standards such as NADCA, NADCAP, AMS2750E… AMS2769, MIL-XXX and CQI-9. These specifications are recognizable and applied on every continent. In India, the furnace specification will not differ significantly from a specification generate in the US. Maybe the final product utilization is not in the same level but at least the standards for process or furnace performance evaluations are the same in every country. Secondly, there are massive efforts in Asia to improve heat treatment quality.

Vacuum Furnace Market.

According to the study conducted by Technavio the equipment vacuum market in 2012 was $610 million business with a 6 % annual growth rate potential. The largest utilization of vacuum equipment is in aviation, automotive, tool, commercial heat treating and medical industries.

Selected Asian Countries Market Characteristics:

Indian Market

Indian heat treatment industry has been progressing steadily in line with the Automobile boom for the last several years. India is becoming a manufacturing hub of small cars for global car companies. There are about 50 furnace companies distributed all over India through regions catering to heat treatment requirements of forgings, castings, machined components and fasteners in the conventional heat treatment processes category like pit type furnaces, rotary & shaker hearth furnaces, boogie, walking beam, pusher furnaces etc.

The major players being Ipsen, High-Temp Furnaces, ALD Dynatech, Aichelin and a dozen of spill over companies who have acquired technology from their association with these above companies.

China Market

China market is facing tremendous competitions with large number of furnace builders and commercial heat treaters. Price and survival is the order of the day but with time there will be consolidation and improvement of profit margin and more investment in innovations and global expansion. According to China Heat Treatment Association the annual heat treatment of steel reaches 41.5 million tons in 2011. Among captive and commercial treating factories, the main goal is to reduce the current power usage of 500 kWh/t to 400 kWh/t by 2015. Major drivers for equipment are the increasing demand for heat treatment in aerospace & aviation, military, automobile, tool and dies, machinery, new energy and rail industries. According to the Heat Treatment Association in China, statistics on the heat treatment market are as follows:

18,000 companies are doing business related to heat treatment

750 companies making components and equipment heat treatment market

The total volume of heat treatment around $12 Billion.

One suppressing data is high percentage of heat treatment is conducted by commercial heat treating companies. According to VDMA study 26% heat treatment in 2011 was done by commercial sector. Very high percentages compare to the US 10% or Europe 20%. Heat treatment service is expected to get more share of the heat treatment market and reach 35% in 2015.

Japan Market

The Japanese heat treatment market is the third biggest in the world. The Japanese Industrial Furnace Manufacturers Association reports that it has 118 member and 54 Associate members – all in a country with slightly smaller area than California. The furnace business is dominated by Chugai Ro, Dowa, IHI and Koyo. Companies from Japan are of excellent quality, are government subsidized R & D, and are in close proximity to the emerging world market in the Pacific Rim. In recent years, several manufacturing industries are moving their manufacturing facility from Japan to ASEAN countries. Below is a private estimate of the Japanese markets leaders.

| Name of the Company | Atmospheric | Vacuum |

| IHI Machinery and Furnace | 1 | |

| Chugai-ro | 1 | 2 |

| Dowa | 2 | |

| Koyo | 3 | |

| Nachi | 4 | |

| Oriental | 5 |

Source: IHI group

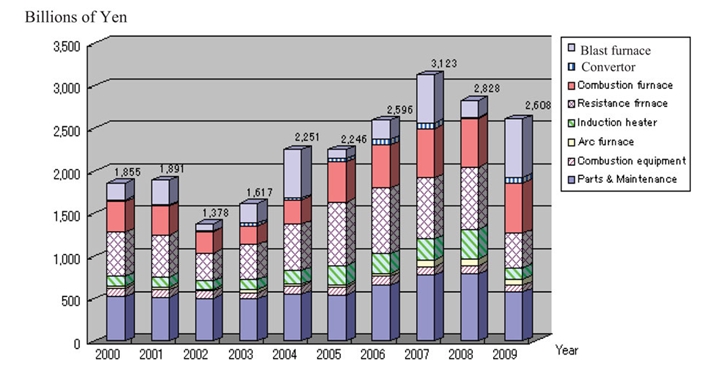

According to JIFMA, the member’s sales have steadily declined since 2008. In 2009 their member sales totaled 2,608 billion yen, or around $2,600,000,000 USD. These figures include steel mill furnaces, so if even 10% of these sales are for heat treat systems, they are selling roughly $260 million dollars a year.

Source JIMA publication March 2012.

The characteristic business module of Japanese commercial heat treatment companies is that they process small lots of parts from hundreds of companies. The prevalent just in time (JIT) delivery requirement pushed commercial heat treatment to adopt a tight schedule, and more importantly, specialized furnace sizes according to fast turn cycles. This explains why the majority of SQF and vacuum furnaces are in the 250 to 750 kg range.

Japanese Heat Treatment service is dominated by several companies:

| Onex 5,850 mil Yen | Nihon Parkerizing 103,489 mil Yen |

| Neturen Turnover 44,600 mil Yen | Dowa (HT only) 18,640 mil Yen |

The South Korean Market.

The South Korean market in many ways is similar to the Japanese market, with 30% of GDP generated by the manufacturing sector. The automobile industry, electronics and shipbuilding industries dominate demand for the heat treatment with small lots and just in time delivery. The majority of furnaces offered by South Korean furnace manufacturers are small to medium sized, for example the SQF with up to 750 kg loading capacity. The market is heavily influenced by Japanese furnace technologies with many furnaces resembling Oriental Engineering and Dowa designs. SAC, Dongwoo and 2000Engineering are the largest furnace companies in Korea. Dongwoo, besides its furnace manufacturing division, also has four commercial heat treating facilities. One of the curiosities of the South Korean market is a pusher furnace offered by SAC with the Low Pressure Carburizing (LPC) that would be very challenging to build and operate. With good success, Daehan Electric Heating Co. manufactures an aluminum brazing furnace to several global heat exchanging OEMs. The South Korean furnaces have acceptable workmanship standards. South Korean furnace companies are expending into Asia (Dongwoo has facilities in China and India) and most likely, within 5 years, South Koreans companies will have more global presence and recognition.

South Korea Heat Treat Treatment demand drivers.

Indonesia

Demand for everything from aircraft parts to cars to machine tools has continued to drive robust economic growth in Indonesia, defying the global uncertainty and domestic concern about resurgent economic nationalism and a widening trade deficit.

Gross domestic product has expanded by 6.1 per cent in the fourth quarter of last year, compared to a year earlier. GDP grew by 6.2 per cent last year, slightly below 2011’s 6.5 per cent as the slowdown in China hit demand for Indonesian commodities such as coal and oil.

Double digit growth of vehicles sales in Asia creates demand for heat treatment in this region. The fastest growing markets are China, India, Thailand and Indonesia.

Global Key Opportunities

Fast growing Asian economics creates market opportunities for heat treatment services and equipment, particularly in India, Thailand, Indonesia and further in time, Vietnam and the Philippines. The vehicles manufactured depend on population size, education (income) and the steel availability in the country or region. We can predict with some degree of accuracy that within the next 10 years’ the high growth will move to Africa. Egypt, Nigeria, Ethiopia and Ghana will have the most growth of heat treatment in a 10 years’ time frame.

Global Process and Furnace Design Improvements

Furnace control systems have changed drastically in the last 10 years. In order to increase the efficiency of the heat treatment process, furnaces are integrated into the manufacturing production flow. Integration is only possible if the control system of the furnace has communication capability with the facility ERP (Enterprise Resource Planning) and CMMS (Computer Maintenance Management System). The furnace control computerization allows furnace integration with the company ERP and CMMS systems. Current development in the control system with PLC/HMI allows instantaneous communication with company production software. The goal is to simplify furnace operation, recording and at the same time increase the reliability and efficiency of the furnace.

The next task in furnace control development is to design control system capable of automatic reasoning during the heat treatment cycle and provide solutions to furnace performance problems. PLC/HMI base controls are designed to analyze furnace performance by monitoring all critical components such as pumps, motors, valves, SCR, contactors, actuators, safety switches, heating elements, water flows, etc. Data indicating parameters outside of acceptable norm triggers an alarm and notification of abnormal parameter.

Furnace design improvements could be described in four ways: First, improvement in furnace design; such as, insulation improvement (lowering heat input per part or weight of the product) or improvement in heat transfer between heat source and the load by utilizing combination of convection, conduction, radiation heat transfer. For example, in most advanced vacuum furnaces are using convection heating from ambient to 1560º F (850ºC) to shorten heat transfer time. By combining radiation and convection heating, the heating cycle is shortened from 10 to 35% depending on load configuration. The second advancement could be described in terms of operation improvement such as the flexibility of the furnace operation and maintenance simplicity. The third way is to improve the heat treatment process by changing to more efficient processes and technologies. The fourth advancement is to provide environmental improvement by lowering or eliminating the entire cost of the disposal of harmful byproducts of heat treatment.

An example of how new technologies are replacing traditional heat treatment equipment is vacuum carburizing. The gas carburizing process that has dominated the market for decades is now being replaced by low-pressure vacuum carburizing (LPC) technology. Within the next decade, new technologies will be introduced into the heat treatment field. The driving force behind developing new equipment is the reduction of the environmental foot print, shortening production cycles and lowering the cost of operation through more efficient utilization of utilities. The low temperature surface modification processes, made attractive by their low distortion, will gain higher market share. Nitriding and sulfonitriding boronization are good candidates for a high growth potential within the next decade. Processes with low COx emission will be replacing the higher and more polluted processes. Vacuum technologies will gain market share in the heat treatment. The major obstacle for more rapid growth of vacuum heat treatment is the high cost of equipment. As vacuum technologies mature, we can predict with a high degree of accuracy that the cost of vacuum equipment manufacturing will decrease. At the same time, the environmental concern will justify a higher cost of vacuum equipment compared to traditional furnaces with a protective atmosphere.

[1] Estimate MTI and IHEA

[2] Monty interview with BD Harris

[3] China Daily Data 3/2013

[4] LCM Automotive

[5] Kowalewski List Global HT

[6] Industrial Heating 2/2012 CH

[7] Kowalewski List Global HT

[8] Kowalewski Global HT

[9] Private conversation Dongwoo

[10] Vacuum Heat Treatment Study 20112

[11] Pratap Ghorpade-Private Consultant

[12] IH Magazine 2/2012 Chinese addition

[13] LCM Automotive

[14] Kowalewski Global HT